Emailing Luv

Southwest Airlines: Emailing Luv

By John Landsman, Director, Strategy and Analytics

“Love” is the very last feeling most of have for today’s airline experience. But Southwest Airlines has successfully built this concept into its brand, consistently making the top tier in customer satisfaction surveys. And in our client reporting, Southwest almost always appears as the top airline for email subscriber overlap with virtually every major client brand we analyze.

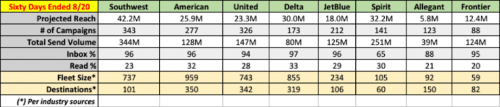

We decided to dig deeper, looking at Southwest’s email audience, activity and performance metrics compared to those of seven other major U.S. airlines: the three “legacy” carriers (American, United and Delta); and four prominent so-called “low-cost” carriers (JetBlue, Spirit, Allegiant and Frontier).

Data are in the table below, reflecting all email activity we detected from each brand over the past sixty days (i.e., supporting marketing and promotion, rewards, and trip cycles). As perspective, the table also shows data on fleet size and number of destinations.

Highlights:

- Southwest does indeed have the largest overall email audience size of any of these airlines, surprising in that the three legacy carriers are truly global airlines and they service three times more destinations than Southwest.

- Southwest also sends more email campaigns than the others, and it deploys a much higher volume of actual email.

- The fact that Southwest’s fleet size is almost is large as those of the global legacy carriers on the much smaller number of Southwest destinations likely reflects the relatively high trip frequencies within each of its routes, and the relative prominence of point-to-point (versus hub-and-spoke) service, both key elements of Southwest’s business model. These factors may in turn account for its more extensive overall email footprint.

- Nevertheless, Southwest produces one of the lower overall read rates in this group (23%). Delta owns the highest read rate (33%); Frontier the lowest (20%). But, given Southwest’s peppier email cadence, its lower read rate belies the higher number of actual read events (impressions) Southwest achieved versus the other carriers.

- Five of these seven carriers produce excellent inbox placement, at or above 94%. Exceptions are Allegiant (a possibly risky 88%), and Spirit (a highly problematic 60%).

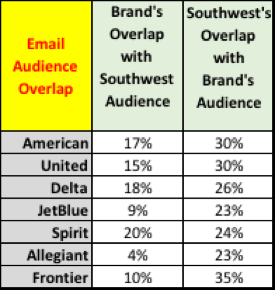

- A look at relative email audience overlaps is also revealing. In the table below, we show overlaps between Southwest and the other carriers. (Read: For American, 17% of Southwest’s email audience also receives American’s email, while 30% of American’s email audience also receives Southwest’s email).

- Every carrier’s audience has a higher percentage of overlap with Southwest than vice versa. In addition, though not shown on the table, for every other carrier, Southwest is that carrier’s highest email audience overlap. This is a(nother) reflection of Southwest’s strong competitive presence in the markets it serves.

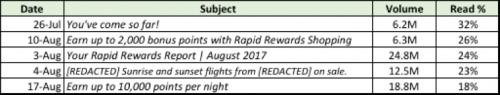

- The table below describes Southwest’s top five performing emails during the analyzed period. Four are rewards-related, but three of those are also promotional, pushing travel for next-tier rewards status, and shopping at participating vendors, and stays at participating hotels. The non rewards-related campaign (8/4) promotes price-off on early and late day flights. For that campaign, note the implied use of personalized subject lines, including reference to the traveler’s known originating city.

So, it appears that Southwest’s approach to email is consistent with other elements of its business model That success of that model is embodied in a now-familiar term, “Southwest Effect,” which describes the prompt lowering of competitive prices wherever Southwest goes. Who needs assigned seats?