'

Trick or Treat: Halloween Email 2017

Article by

Chris Adams

CATEGORIES: eCommerce, Holiday/Event, Retail, Trends & Analysis

TAGS: Halloween

In homes with kids, the plastic pumpkin-pails full of candy are still sitting around, all that loot begging to be eaten, and creating undue temptation for theft by older family members. One of my young grandsons guards his stash like Ft. Knox. and just as the goodies compel our attention, so do the emails that drove their purchase.

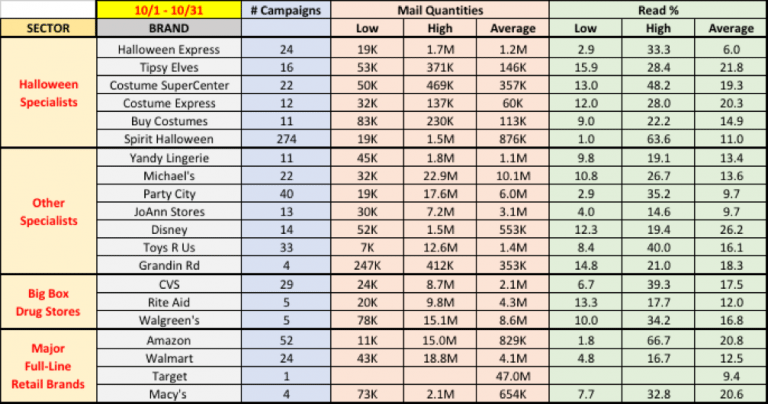

Our look at Halloween this year focuses on related email activity and engagement at twenty representative retailers, divided among four sectors, as shown in the table below. This approach is an extension of similar research we’ve recently completed for ‘Internet Retailer.’

Methodology

- The data reflect activity tracked between October 1-31. We did see a smattering of related activity in September, an even smaller amount in August, and virtually nothing before that.

- For the brands with Halloweenor Costume(s) in their names, all their emails for the period were included in this analysis.

- For the other brands, related emails were filtered for inclusion if their subject lines contained any combination of ten common Halloween-related words.

Observations

- With the exception of Spirit Halloween, most brands deployed relatively few Halloween-themed campaigns, with Amazon, Party City, Toys R Us and CVS, showing the top numbers from among the other brands. The majority of this activity deployed in the last two weeks of October. Target’s single Halloween campaign may seem surprising, but in the past we’ve also not seen Target jump as heavily into Halloween as we might have expected. Macy’s, too, is relatively light. Kohl’s (not shown) mailed none. While CVS hit the event relatively hard, Rite Aid and Walgreen’s were far less active.

- For the smaller, Halloween/costume focused brands with relatively small estimated overall email audiences (not shown), campaign send sizes suggest a relatively low degree of targeting, since the limited-time event demanded maximum audience leverage. For the major brands, with wide assortments and large email audiences, Halloween send sizes reflect a very significant amount of targeting. Target was an exception in this category. Their one related mailing was to a very high percentage of their email audience, giving them significant (if not curated) impressions on that one mailing.

- Many of the top-performing emails (and many others, as well) reflected a surprising amount of aggressive price discounting — and this can be seen throughout the period; not just at the end. One of Amazon’s top-performing Halloween emails referenced discounts of up to 63%.

- Although most brands drove generally acceptable (80-90%) inbox deliverability (not shown), one brand — Halloween Express — registered a 25% inbox rate (i.e., a 75% spam rate), which may be partly responsible for their dismal average read rate showing (6%). Inbox issues of this magnitude are often the result of (among other factors) shoddy email address acquisition and opt-in practices, and/or little or no list hygiene.

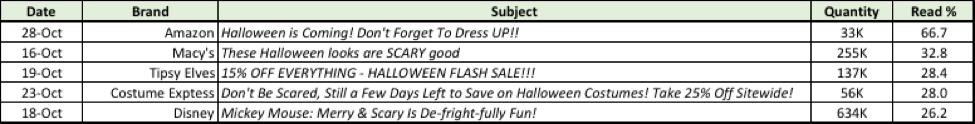

- As for reader engagement, Amazon, Tipsy Elves, Costume Express, Macy’s and Disney all drove average read rates in excess of 20%. Examples of their best performing emails are shown in the table below.