'

Amazon Prime Day — Epilog

Amazon Beats Last Year: More Prime Customers, but Lower Spends Per Customer

By John Landsman, Director of Strategy and Analytics

Beyond the customary Holiday hype surrounding Black Friday and Cyber Monday, few retail events command the intense interest now attached to Amazon’s Prime Day, which observed its first anniversary this past week (July 12th versus July 15th for last year’s event). Following the event Preview we shared last week, we took a longer look at how Amazon used email to support this event, how that email performed, how we saw the event itself doing, and what key retail competitors did about it. Information shared below is in addition to content in last week’s Preview

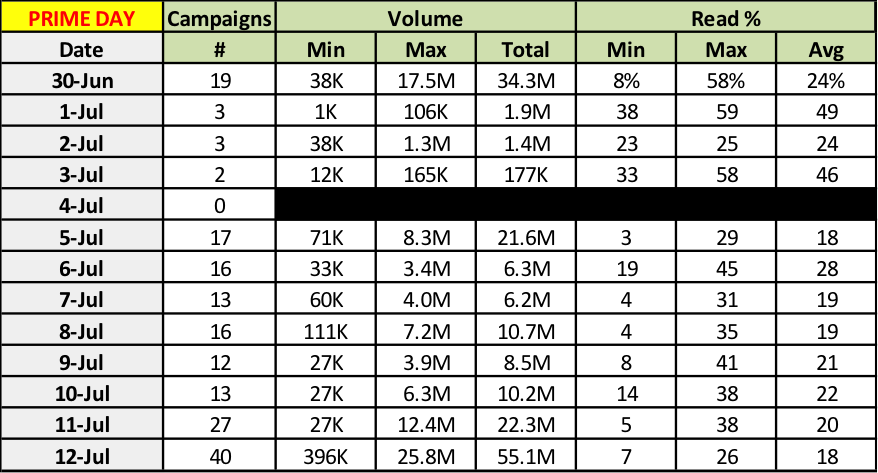

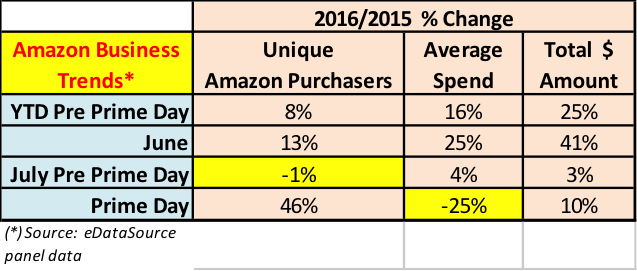

Bottom-line? Between June 30th and July 12th, we detected 181 Amazon Prime Day email campaigns, totaling an estimated 179 million emails. Read rates by campaign ranged from single digits up to nearly 60%, but averaged about 24%. The event created positive lift versus last year’s Prime Day, but did that by increasing the number of Prime Day purchasers by almost 50%. Average event spends per customer actually decreased by about 25%. Other major multi-channel retailers attempted to counter Amazon’s Prime Day energy with large email campaigns supporting splashy events of their own (e.g., Macy’s “Black Friday in July”) but these commanded read rates that were generally about 40% lower than those of Amazon’s Prime Day event average.

Details follow.

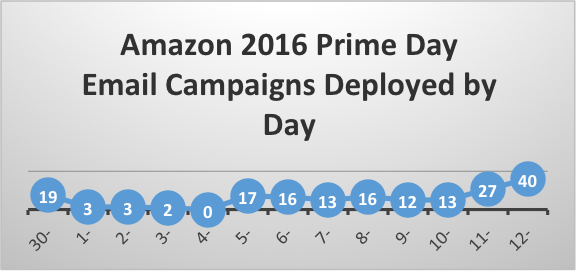

- Campaigns Mailed: Amazon announced the event on June 30th, with 19 related email messages; stayed fairly quiet across the long July 4th weekend, picked up the pace over the next few days, building to its largest send day (40 campaigns) on Prime Day itself.

- Volumes Deployed: The June 30th Kick-off day saw over 34 million Prime Day emails, and then — following the July 4th weekend lull — a daily send cadence ranging from 6-22 million emails, building to a maximum of 55 million sent on Prime Day itself.

- Read rate performance: Daily read rates were high-moderate to strong throughout Amazon’s Prime Day email series. Other than the very high read rates on July 1st and 3rd (associated with the relatively small send volume on those days), the highest (average) read rates occurred on the June 30th kick-off day (24%), and on July 6th (28%).

- Note: Detail for the above activity metrics can be found in the Appendix

- Campaign Examples by Day: The table below shows examples of Prime Day related emails sent on each of the major days of the Amazon email sequence associated with this event. While each day saw widely distributed generic emails supporting this event, there were also numerous campaigns related to specific merchandise or service categories, undoubtedly tightly targeted to appropriate customer segments. All of these emails produced high-moderate to strong read rates, the highest of which is associated with a very small audience, and offering “Free Same Day Delivery.” Across the event, Prime Customers would likely have received almost one related email per day, about evenly divided between product/service-specific messaging and generic announcements.

- Prime Day Business Impact: Amazon had the challenge of beating their Prime Day performance last year. They appear to have succeeded (see table below), bettering their sales by about 10% versus Prime Day last year. This lift was accomplished solely by having increased the number of Prime Day buyers by almost 50%. Average Prime Day spends decreased by 25%. Also, this year-over-year uptrend is not as strong as the pre Prime Day year-over-year uptrends we see. The exception is in the part of July preceding Prime Day, but while Prime Day announcements were occurring. In that period, there is evidence that the number of Amazon buyers actually decreased versus last year, likely owing to their deferring purchase activity until Prime Day itself.

- What Key Amazon Competitors Did on Prime Day: As we’ve observed, it’s hard for Amazon’s major competitors to fight its massive proprietary branded promotional event without in effect promoting it themselves. Yet Prime Day is also difficult for them to ignore, since about half their email subscribers are also receiving email from Amazon. Some of these brands admit to building special promotional effort into their calendars; some claim they’ve maintained their usual promotional tempo. But on Prime Day itself, all of them deployed major email campaigns, to large percentages of their email lists, most with aggressive promotional language in their subject lines. But none of them produced read rates on anything like the scale of those we see on average from Amazon’s Prime Day emails

-

APPENDIXAmazon Prime DayEmail Activity Detail